Almost all types of “business equipment” new or used that your company buys or finances will qualify for the Section 179 Deduction.

A huge technology procurement incentive still exists for businesses looking for ways to become more efficient and lease or purchase new business equipment.

But the clock is ticking.

Section 179 Deduction of the IRS Tax Code is an immediate expense deduction that business owners can take for purchases of depreciable business equipment, an incentive created by the US government to encourage businesses to buy equipment and invest in themselves. But businesses must act fast: The equipment must be financed or purchased and put into service by the end of the day on Dec. 31, 2021.

Almost all types of “business equipment” new or used that your company buys or finances will qualify for the Section 179 Deduction. See a full list here. This could include:

- copiers/printers/MFPs,

- production print systems,

- production finishing equipment,

- paper shredders,

- computers,

- Computer “Off-the-Shelf” Software

What’s the Deduction, Exactly?

Essentially, Section 179 of the IRS tax code allows businesses to deduct the full purchase price of qualifying equipment and/or software purchased or financed during the tax year. That means that if you buy (or lease) a piece of qualifying equipment, you can deduct the FULL PURCHASE PRICE from your gross income, as shared on the official Section 179 Deduction website.

What are the Deduction Details in 2021?

2021 Deduction Limit = $1,050,000

This deduction is good on new and used equipment, as well as off-the-shelf software. To take the deduction for the tax year 2021, the equipment must be financed or purchased and put into service between Jan. 1, 2021, and the end of the day on Dec. 31, 2021.

2021 Spending Cap on Equipment Purchases = $2.62 Million

This is up from $2.59 Million in 2020. This is the maximum amount that can be spent on equipment before the Section 179 Deduction available to your company begins to be reduced on a dollar-for-dollar basis.

Is Leasing an Option?

Yes. Using Section 179 with an Equipment Lease or an Equipment Financing Agreement might be a highly profitable decision for your organization. According to Section179.org:

Besides using a Section 179 Qualified Equipment Finance Agreement (EFA) like we’ve been discussing, did you know that your company can also lease equipment and still take full advantage of the Section 179 deduction? The main benefit of a non-tax capital lease is that you can still take full advantage of the Section 179 Deduction, yet make smaller payments. With a non-tax capital lease you can acquire and write-off up to the deduction limit worth of equipment this year, without actually spending that amount this year.

In other words, a small business that is managing cash flow can leverage a non-tax capital lease to minimize out-of-pocket cash, and still take the full Section 179 Deduction.

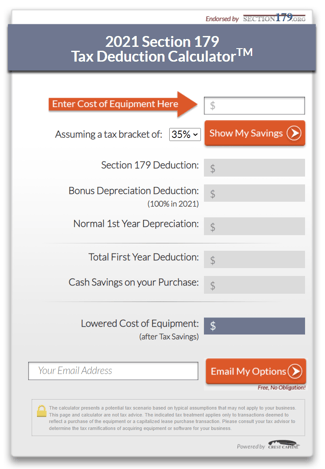

Where Can I Crunch the Numbers?

Interested in crunching the numbers? The online calculator will help you visualize a potential tax benefit scenario by leveraging Section 179 of the IRS tax code.

How Can Datamax Help?

If you're interested in taking advantage of this incentive and, please give us a call. We've been in business for more than 60 years and have provided in-house leasing services since 1975 through the Datamax Leasing Division. With Datamax, you can “lease with ease” and take advantage of technology to grow your business now instead of waiting.