Almost all types of “business equipment” new or used that your company buys or finances will qualify for the Section 179 Deduction and/or Bonus Depreciation.

Need a little additional "incentive" to close out your year with the acquisition of office technology? Section 179 and Bonus Depreciation are two components of the 2017 TCJA (Tax Cuts and Jobs Act) that present potential tax savings for your organization if you're in the market for copiers, printers, or other related technology hardware or software.

But you'll need to act fast. To maximize the current incentive, qualifying equipment must be financed or purchased before January 1, 2023.

What is Section 179?

Section 179 Deduction of the IRS Tax Code is an immediate expense deduction that business owners can take for purchases of depreciable business equipment. If you buy (or lease) a piece of qualifying equipment (or software), you can potentially deduct the full purchase price from your gross income,

What is Bonus Depreciation?

According to the Internal Revenue Service, Bonus Depreciation "allows taxpayers to deduct a specified percentage (30, 50, or 100 percent) of depreciation in the year the qualifying property is placed in service." The rules allow Bonus Depreciation to reach 100 percent for all qualified purchases made between September 27, 2017 and January 1, 2023. Bonus Depreciation then ramps down starting in 2023.

What type of equipment qualifies?

For Section 179, almost all types of “business equipment” that your company buys or finances will qualify for the Section 179 Deduction. See a full list here. This could include:

- copiers/printers/MFPs,

- production print systems,

- production finishing equipment,

- paper shredders,

- computers,

- Computer “Off-the-Shelf” Software

Regarding Bonus Depreciation, qualified business purchases include property that has a useful life of 20 years or less (like office equipment), qualified improvement property (aka improvements to the interior of "nonresidential real property"), and computer software.

What about used equipment?

Yes, in both instances, used equipment qualifies. However, while the law now allows for Bonus Depreciation on used equipment, the IRS states that it must be "first use" by the purchasing business.

What are the Section 179 Deduction details in 2022?

2022 Deduction Limit = $1,080,000

This deduction is good on new and used equipment, as well as off-the-shelf software. To take the deduction for the tax year 2022, the equipment must be financed or purchased and put into service between January 1, 2022, and the end of the day on December 31, 2022.

2022 Spending Cap on Equipment Purchases = $2.70 Million

This is up from $2.62 Million in 2021. This is the maximum amount that can be spent on equipment before the Section 179 Deduction available to your company begins to be reduced on a dollar-for-dollar basis.

How do the two work together?

While there is potential benefit in combining them, there are a few important notes to consider.

- IRS rules require that most businesses apply Section 179 first, followed by Bonus Depreciation.

- The Section 179 expense limit, along with the $2.7 million phase-out threshold, applies only to taxpayers with specific business scenarios. Bonus Depreciation, meanwhile, does not have that upper threshold.

- The bottom line? We recommend that you consult your tax accountant or qualified tax professional to navigate how one or both of these incentives should be utilized to your best benefit.

Is leasing an option?

Yes. Using Section 179 with an Equipment Lease or an Equipment Financing Agreement might be a highly profitable decision for your organization. According to Section179.org:

Besides using a Section 179 Qualified Equipment Finance Agreement (EFA) like we’ve been discussing, did you know that your company can also lease equipment and still take full advantage of the Section 179 deduction? The main benefit of a non-tax capital lease is that you can still take full advantage of the Section 179 Deduction, yet make smaller payments. With a non-tax capital lease you can acquire and write-off up to the deduction limit worth of equipment this year, without actually spending that amount this year.

In other words, a small business that is managing cash flow can leverage a non-tax capital lease to minimize out-of-pocket cash and still take the full Section 179 Deduction. Examples of non-tax capital leases include a ‘$1 Buyout Lease’ and a ‘10% Purchase Upon Termination (PUT) Lease.’

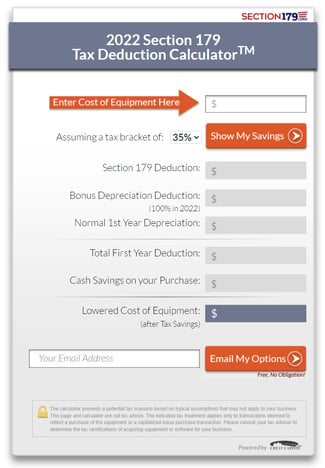

How can I calculate potential savings?

Interested in crunching the numbers? This handy online calculator will help you visualize a potential tax benefit scenario by leveraging Section 179 of the IRS tax code.

Our advice? Consult a tax expert.

While this blog is intended to help you better understand the benefits of Section 179 and Bonus Depreciation, it is intended for informational purposes only. Before moving forward, we can't recommend enough seeking out the consultation of your qualified tax expert to best navigate these incentives.

How can Datamax help?

If you're interested in taking advantage of this incentive and reaping the benefits of these tax incentives, we'd love to visit. Additionally, our in-house leasing services offer an added "bonus" to your acquisition journey. With Datamax, you can “lease with ease” and take advantage of technology to grow your business now instead of waiting.