Essentially, Section 179 of the IRS tax code allows businesses to deduct the full purchase price of qualifying equipment and/or software purchased or financed during the tax year. That means that if you buy (or lease) a piece of qualifying equipment, you can deduct the FULL PURCHASE PRICE from your gross income.

As organizations continue to wrestle with workflow challenges and seek ways to expedite routine business processes through technology, Section 179 presents a unique procurement opportunity.

Section 179 Deduction of the IRS Tax Code is an immediate expense deduction that business owners can take for purchases of depreciable business equipment, an incentive created by the US government to encourage businesses to buy equipment and invest in themselves. Section 179 could be a big incentive for companies looking to gain the necessary technology equipment before the end-of-the-year deadline. Hardware could include:

- copiers/printers/MFPs,

- production print systems,

- production finishing equipment,

- paper shredders,

- desktop computers/laptops,

- network security hardware, etc.

In addition, as organizations adjust to the realities associated with conducting business amid a pandemic, the Section 179 Deduction opens the ability to purchase relevant equipment for conforming to COVID-19. In 2020, equipment that's purchased to modify businesses according to coronavirus restrictions, generally, will qualify for the tax deduction.

This includes:

- sanitizing stations,

- temperature check stations,

- dividers/plexiglass shielding,

- and new printed signage.

Temperature check stations and, specifically, body temperature screening kiosks, record temperatures in one second with a simple glance into the display, with optional facial recognition capabilities. They provide instant email alerts for abnormal temperate readings.

What’s the Deduction?

Essentially, Section 179 of the IRS tax code allows businesses to deduct the full purchase price of qualifying equipment and/or software purchased or financed during the tax year. That means that if you buy (or lease) a piece of qualifying equipment, you can deduct the FULL PURCHASE PRICE from your gross income, as shared on the official Section 179 Deduction website.

What are the Deduction details in 2020?

2020 Deduction Limit = $1,040,000

This deduction is good on new and used equipment, as well as off-the-shelf software. To take the deduction for tax year 2020, the equipment must be financed or purchased and put into service between January 1, 2020 and the end of the day on December 31, 2020.

2020 Spending Cap on Equipment Purchases = $2,590,000

This is the maximum amount that can be spent on equipment before the Section 179 Deduction available to your company begins to be reduced on a dollar for dollar basis. This spending cap makes Section 179 a true “small business tax incentive” (because larger businesses that spend $3,630,000 or more on equipment won’t get the deduction.)

Bonus Depreciation: 100% for 2020

Bonus Depreciation is generally taken after the Section 179 Spending Cap is reached. The Bonus Depreciation is available for both new and used equipment.

What are the advantages of leasing?

Using Section 179 with an Equipment Lease or an Equipment Financing Agreement might be a highly profitable decision for your organization.

Why? Because, according to the Section 179 website, "the taxes you save with the deduction will almost always exceed your cash outlay for the year when you combine (i) a properly structured Equipment Lease or Equipment Finance Agreement with (ii) a full Section 179 deduction."

What do the numbers look like?

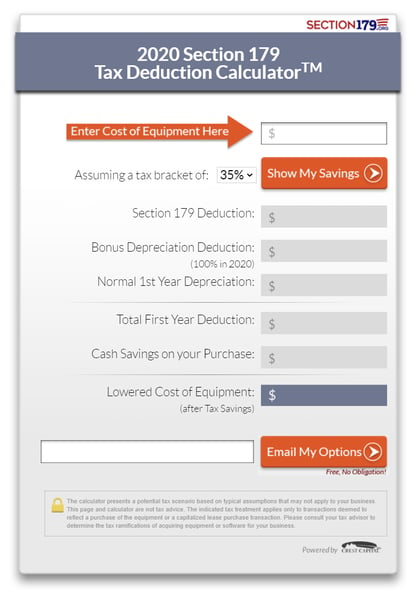

Interested in crunching the numbers? The online calculator above will help you visualize a potential tax benefit scenario by leveraging Section 179 of the IRS tax code.

What can Datamax do to help?

If you're interested in taking advantage of this incentive and boost, please give us a call. We've been in business for more than 60 years and have provided in-house leasing services since 1975 through the Datamax Leasing Division. By leasing with Datamax, you can take advantage of technology to grow your business now instead of waiting.

Note: Please consult your tax advisor regarding your company's particular tax scenario.