The IRS Section 179 Deduction represents an incentive created by the U.S. government to encourage businesses to buy equipment and invest in themselves.

So, it's the end of another business year and once again you find yourself looking for opportunities in every nook and cranny to improve profitability or searching to boost productivity with some much-needed business technology investment. I don't know about you, but I'd much rather wear myself out looking at endless college football games than wearing myself out trying to improve profits under a late year pressure crunch. Now that's a beat down. Either way, for most business managers or owners a "best-case" year-end bonus is probably on the line, or "worse-case" — the stress of ensuring basic business survival.

To help you out, here's an incentive you may not be aware of. It's Section 179 Deduction of the IRS Tax Code — and its incentives can be "BIG" for small businesses.

With the help of a great website http://www.section179.org, let's take a closer dive...

The Deduction defined.

As outlined at http://www.section179.org, "essentially, Section 179 of the IRS Tax Code allows businesses to deduct the full purchase price of qualifying equipment and/or software purchased or financed during the tax year.

That means that if you buy (or lease) a piece of qualifying equipment, you can deduct the FULL PURCHASE PRICE from your gross income. This represents an incentive created by the U.S. government to encourage businesses to buy equipment and invest in themselves."

The Deduction specifics for 2017.

1) 2017 Deduction Limit = $510,000

This deduction is good on new and used equipment, as well as off-the-shelf software. To take the deduction for the 2017 tax year, the equipment must be financed/purchased and put into service between January 1, 2017 and the end of the day on December 31, 2017.

2) 2017 Spending Cap on Equipment Purchases = $2,030,000

This is the maximum amount that can be spent on equipment before the Section 179 Deduction available to your company begins to be reduced on a dollar for dollar basis. This spending cap makes Section 179 a true "small business tax incentive" (because larger businesses that spend more than $2.5 million on equipment won't get the deduction.)

3) Bonus Depreciation: 50% for 2017

3) Bonus Depreciation: 50% for 2017

Bonus Depreciation is generally taken after the Section 179 Spending Cap is reached. Please Note that the Bonus Depreciation is available for new equipment only. Used equipment qualifies for Section 179 Deduction, but does not qualify for Bonus Depreciation.

So "NOW" what?

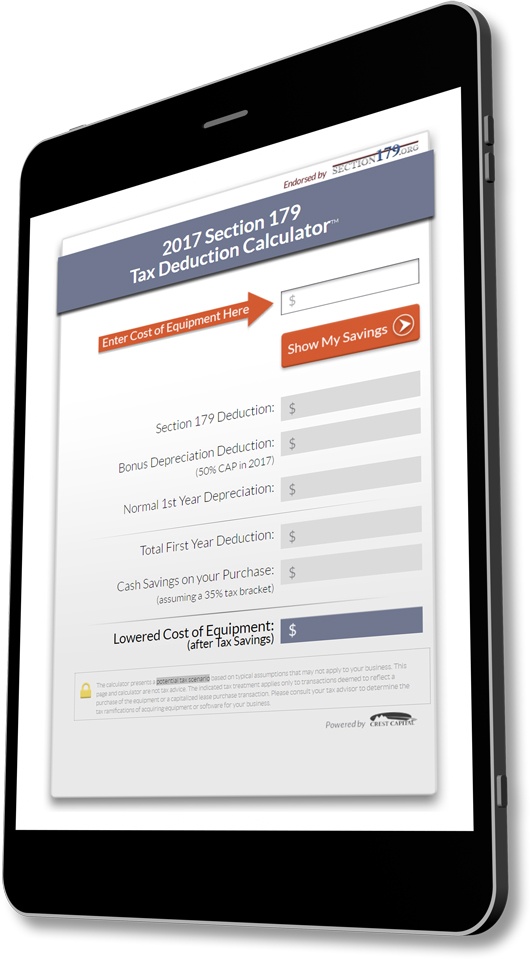

If you're interested in reviewing your own incentives in purchasing, financing, or leasing qualified equipment/software for 2017, try out this online calculator. It can help you visualize a "potential" tax benefit scenario leveraging Section 179 of the IRS Tax Code.

Whether you try it out or not, we would always recommend a quick call to your tax accountant or advisor to validate its application for your business.

If you're ready to take advantage of this opportunity now, please give us a call. We've been in business for over 60 years and have provided in-house leasing services since 1975 through the Datamax Leasing Division, so we can definitely help.

Here's to a more profitable New Year for you and your business!

Source: http://www.section179.org/section_179_deduction.html